As 2018 draws to a close, specialized truck buyers are rushing to take advantage of the IRS Section 179 deduction. If the acquisition of trucking equipment is important to grow and run your own business, then you should be similarly excited about Section 179 and take action as soon as possible.

The new and improved clauses in Section 179 makes 2018 an incredible year to save on taxes.

At Custom Truck One Source, we are receiving a lot of queries from potential buyers of specialized trucks – dump trucks, boom trucks, forestry trucks, building supply trucks, diggers, trailers etc. – about how they can take advantage of Section 179 before December 31st, 2018.

In this article, we’re answering 11 most common questions customer ask us about Section 179. And while this is by no means legal advice on how you can use Section 179 to improve your business, we are the first single-source provider of specialized trucks and heavy equipment solutions in North America and have the largest rental line-up in the nation.

If you have any questions about purchases or leases before December 31st, 2018, do call us at 844-282-1838 or Email us at: [email protected]. We’re standing by to help you get the most value from Section 179 deductions. We have the largest selection of equipment to suit every budget.

#1: Why is Section 179 Deduction Such an Exciting Proposition In 2018?

- The $500,000 limit of 2017 has extended to $1,000,000 in 2018. This means small business owners can deduct the full purchase price of qualifying equipment purchased or financed during the tax year. So if you buy/lease qualifying equipment, you can deduct the full purchase price from your gross income. This is a rare incentive that the U.S. government is offering to encourage small and medium-sized businesses to look forward, buy equipment and do a faster and quicker job of scaling their operations for their future.

#2: Has the Bonus Depreciation Also Been Raised?

- Yes. The bonus depreciation has also increased to 100% through 2022. It covered only `new’ equipment until the most recent tax laws passed. Fortunately, recently `used’ equipment is also included.

Bonus Depreciation is useful to very large businesses spending more than the Section 179 Spending Cap (currently $2,500,000) on new capital equipment.

#3: What About the Phase-Out Purchase Limit?

- From $2,030,000 in 2017, the phase-out limit has increased to $2,500,000 which means your deductions will start to decrease dollar-for-dollar only after you have exceeded this new limit.

For example, if you purchased $4 million worth of equipment, you would now be $1,500,000 over the phase-out purchase limit, and your deduction would decrease by $1,500,000.

#4: What is the Big Advantage Of Section 179?

- The major advantage of Code Section 179 expensing is that it is flexible. It lets business-owners choose between individual assets compared to bonus depreciation. This also allows for a 100% write-off, but has to be elected for an entire class of assets.

#5: What is the Disadvantage Of Section 179?

- Yo can only use it if the trade or business has taxable income for the year.

#6: Where Can We Find A Section 179 Calculator?

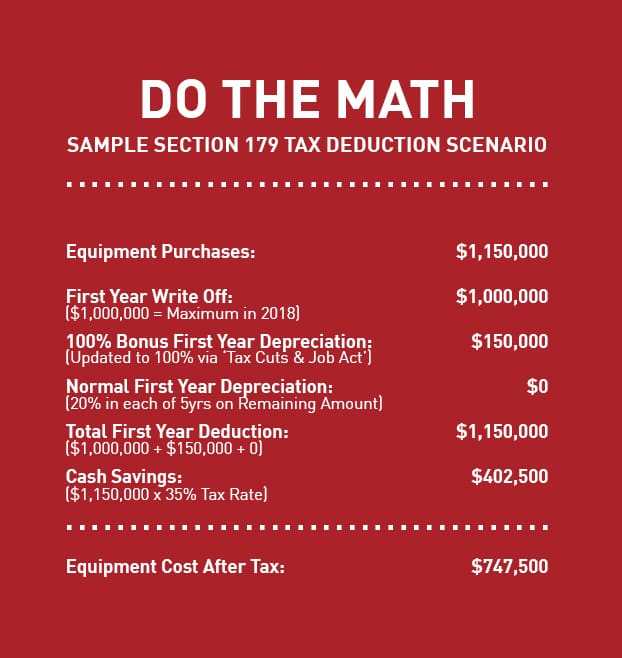

- Here’s an updated example of Section 179 at work during the 2018 tax year. (Source: Section179.org)

#7: Are Specialized Trucks An Eligible Deduction?

- Absolutely! Which is why we’re urging buyers to act before December 31, 2018. Take advantage of the deductions on new, used and leased specialized trucks and heavy equipment from Custom Trucks One Source. (Check out our inventory by clicking here.)

#8: How Can Section 179 Be Combined With Equipment Financing?

- This is a very important conversation to have with your financial lender. According to Justin Forbrook, Vice President at U.S. Bank: “The amount you deduct will almost always exceed your cash outlay for the year when you combine (i) a properly structured Equipment Lease or Equipment Finance Agreement with (ii) a full Section 179 deduction. It is a bottom line enhancing tool (plus, you get the new equipment you’re adding to your business).”

#9: What Is Section 179 Depreciation Recapture?

- If you sell an asset after taking depreciation on it, you have to declare the amount you sold it for as “income”, in order to “recapture” the income on the depreciation you have just taken.

#10: What Is A Section 179 Carryover?

- In case you have taken a Section 179 deduction in excess of your taxable income, you can carry that amount over to the next year. For example: You take $50,000 of Section 179, but only have $20,000 of taxable income before the deduction. The $30,000 carries forward to the next tax year.

#11: What Is Section 179 Amended Return?

- You go back to a previous year and amend the return to change the amount taken.

* This information is provided for general use only and does not constitute specific tax or legal advice on any particular matter. We expressly disclaim any liability resulting from reliance on this information. Please discuss any specific circumstances with your accounting, legal and tax advisors.

* Sources: Section179.org, DeltaModTech and HawkinsAshCPAs.