This is the last and final call for specialized trucks buyers to get proactive about the Section 179m tax deduction and scale their operations to the next level.

Time is running out!

The IRS Section 179 tax deduction helps small and medium-sized businesses just like yours to expand and grow. However, nothing’s going to come of it if you don’t take action before December 31st 2018!

So does the date of acquisition of specialized trucks and heavy equipment have an impact on the Section 179 deduction?

Yes!

It is imperative that the trucking and related heavy equipment you need be bought or leased and put into service by December 31, 2018 if you want to take advantage of the incredible opportunity that Section 179 is now offering you to help you achieve the kind of financial success you always dreamed of.

The new and improved IRS Section 179 deduction for 2018 can be a life-saver for small and medium-sized business owners because they can invest right now in new and used equipment and realize tax write-offs on their 2018 IRS tax returns of up to 1 million dollars. This is a great tax benefit that your business can leverage to buy new equipment and get a huge write-off.

Specialized truck-related businesses are using Section 179 to purchase or lease necessary equipment, instead of waiting, and the entire cost of qualifying equipment is being written off on the 2018 tax return (up to $ 1,000,000).

While the deduction limit for 2018 is $ 1,000,000, there is a $ 2,500,000 spending cap on equipment purchases. This is the maximum amount a business can spend on equipment before the Section 179 Deduction begins to reduce.

See why this spending cap makes Section 179 such a true “small business tax incentive”? Larger businesses that spend more than $3.5 million on equipment won’t get the deduction. Above all, it’s main purpose is to help small businesses flourish and thrive.

But you must purchase the qualifying equipment and place it into service between January 1st, 2018 and December 31st, 2018.

Which is why you have to TAKE ACTION RIGHT NOW!

Contact Custom Truck One Source right away, so we can simplify your specialized truck equipment needs before December 31, 2018!

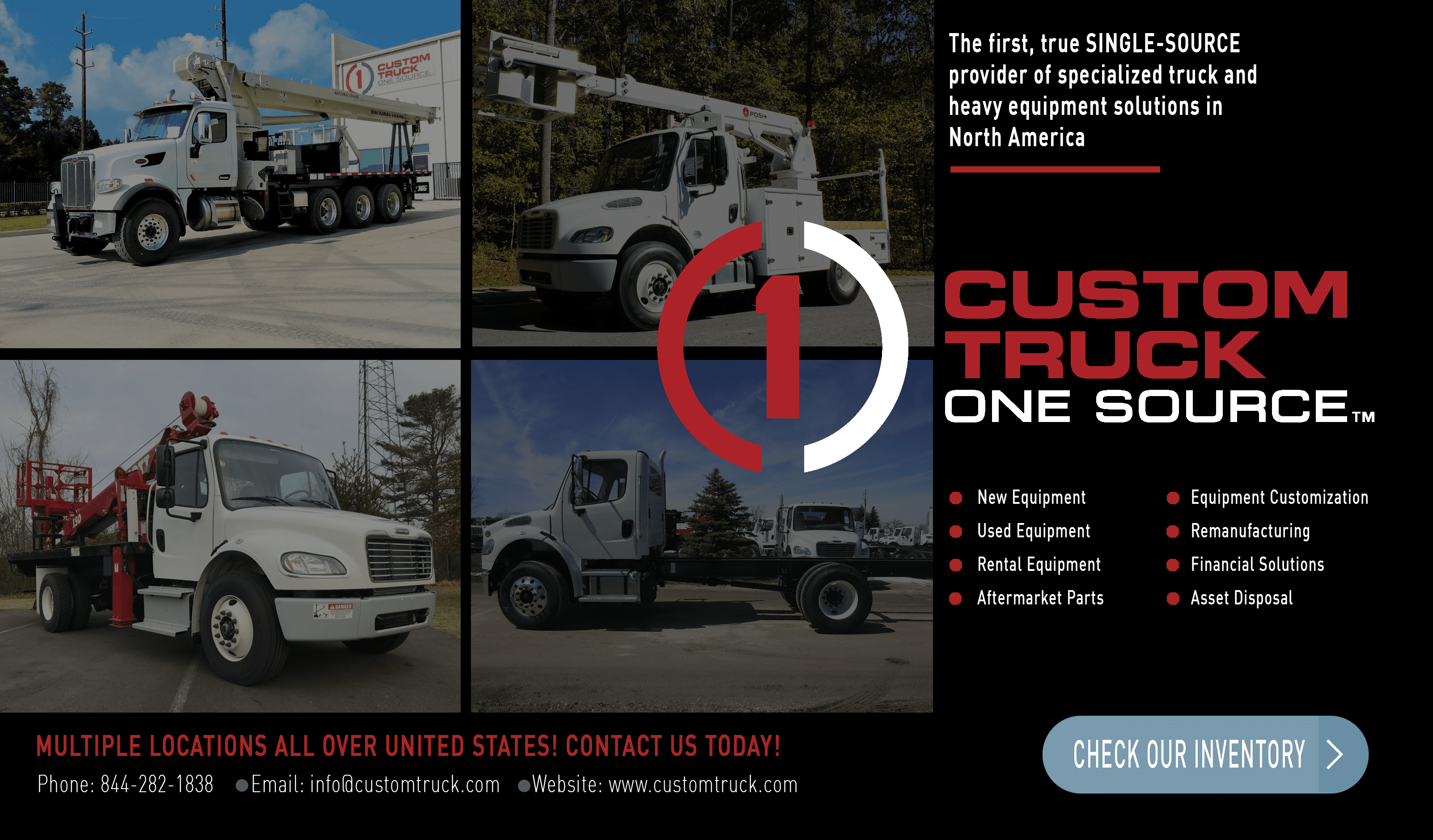

Custom Truck One Source is the first true single-source provider of specialized truck and heavy equipment solutions. With sales, rentals, aftermarket parts and service, equipment customization, remanufacturing, financing solutions, and asset disposal, our team of experts, vast equipment breadth and integrated network of locations across North America offer superior service and unmatched efficiency for our customers.

Contact us at:

Custom Truck One Source

Phone (844) 282-1838

Email: [email protected]

* This information is provided for general use only. It does not constitute specific tax or legal advice on any particular matter. We expressly disclaim any liability resulting from reliance on this information. Please discuss any specific circumstances with your accounting, legal and tax advisors.Quick references collated from Section179.org