If you’re still weighing your options on how to make the best use of Section 179, we want to remind you that there are only a few short weeks left to make up your mind.

It is mandatory that you buy the heavy equipment you need and put them into service by December 31, 2019 if you want to take advantage of the incredible opportunity that Section 179 is now offering you to help you achieve the kind of financial success you always dreamed of.

According to a survey conducted by the National Federation of Independent Business (NFIB), 70 percent of small business owners took advantage of Section 179 last year.

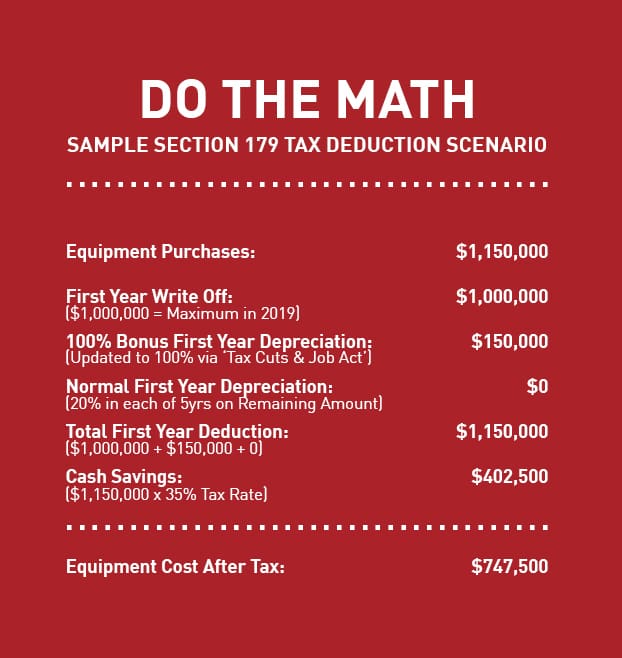

The latest IRS Section 179 deduction for 2019 also comes as a godsend for small and medium-sized business owners because they can invest right now in new and used equipment and realize tax write-offs on their 2019 IRS tax returns of up to 1 million dollars.

- 2019 Deduction Limit: $1,000,000

- 2019 Spending Cap on Equipment Purchases: $2,500,000

- Bonus Depreciation: 100% for 2019

Click here to view all available inventory.

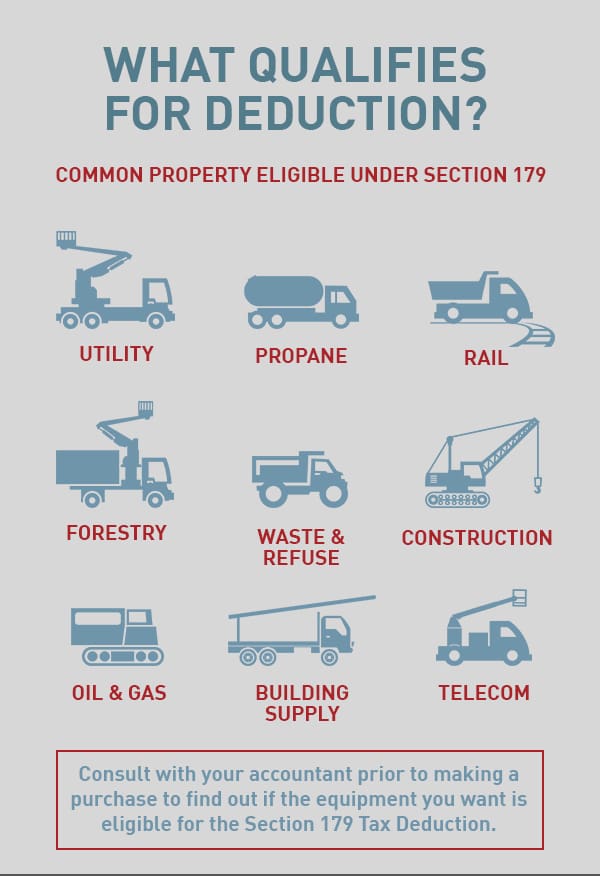

Material goods that generally qualify for the Section 179 Deduction are:

- Equipment (like vocational trucks for example) purchased for business use.

- Tangible personal property used in business.

- Business Vehicles with a gross vehicle weight in excess of 6,000 lbs (see Section 179 Vehicle Deductions)

- Computers and off-the-shelf computer software

- Office Furniture

- Office Equipment

- Property attached to your building that is not a structural component of the building (for example, a printing press or large manufacturing tools and equipment)

- Partial Business Use (equipment that is purchased for business use and personal use: generally, your deduction will be based on the percentage of time you use the equipment for business purposes).

- Certain improvements to existing non-residential buildings: fire suppression, alarms and security systems, HVAC, and roofing.

All the above equipment qualifies whether new or used (but must be new to you), and also regardless of whether it was purchased outright, leased, or financed.

But it is important that you take action now, because Section 179 has historically been known to change without notice. (In 2015, the limit dropped from $500,000 to $25,000.)

Need equipment and financing? Get in touch with us as soon as possible!

Custom Truck One Source is the first true single-source provider of specialized truck and heavy equipment solutions in the country. And our representatives are standing by help you get the most benefit out of Section 179.

THIS INFORMATION IS PROVIDED FOR GENERAL USE ONLY AND DOES NOT CONSTITUTE SPECIFIC TAX OR LEGAL ADVICE ON ANY PARTICULAR MATTER. ANY LIABILITY RESULTING FROM RELIANCE ON THIS INFORMATION IS EXPRESSLY DISCLAIMED. PLEASE DISCUSS ANY SPECIFIC CIRCUMSTANCES WITH YOUR ACCOUNTING, LEGAL AND TAX ADVISORS.